Get Started With

servzone

Overview of GST Registration

According to the GST Regimes, businesses whose turnover gets over Rs. 40 lakhs* (Rs 10 lakhs for North Eastern – All hilly states) is obliged to register as a “normal taxable person”. This overall registration process is called GST registration, and for some businesses, registration under GST is mandatory. You should note that this will be an offense under GST and if the organization does business without registration under GST then heavy penalty will apply. GST registration takes 15-30 working days. Excluding business without GST registration is considered an offense under GST law.

What is GST (Goods and Service Tax)?

GST is the largest tax reform imposed on goods and services in India, which takes both state (VAT, Entertainment Tax, Luxury Tax, Octroi) and central taxes (CST, service tax, excise). This will help the end consumer like us to bear the GST charged by the last dealer in the supply chain. After all, One Nation One Tax is the slogan of our Prime Minister Shri Narendra Modi.

Note: In order to exempt taxpayers, CBIC (Central Board of Indirect Taxes and Customs) introduced two threshold limits for exemption from registration on 1 July 2017. If the total turnover of a business increases by more than INR 40 lakhs, then GST registration is required for that business. There are exemptions for North Eastern states and other states including Jammu and Kashmir, Himachal Pradesh and Uttarakhand. The limit of these states is INR 20 lakhs which was INR 10 lakhs earlier.

GST registration is mandatory for businesses whose business falls under the criteria mentioned above. If such business organizations do business without registration under GST, it would be considered a punishable offense and liable to pay heavy fines. Here at servzone, your firm's GST registration is completely online and convenient.

What is GST (Goods & Service Tax)?

As per the place of many indirect taxes, GST is a goods and services tax levied by the government on taxpayers. Any business offering sales of any goods with an annual turnover of 40 lakhs or an annual turnover of 20 lakhs will be required to do GST registration and have a valid GST number. You should note that the Goods and Services Tax Act was passed in Parliament on 29 March 2017, and came into execution on 1 July 2017. This type of taxation is a multi-tiered, comprehensive, destination-based tax imposed on each. And add every value

When customers, shopkeepers or consumers pay GST, it is transmitted by the government to organizations selling goods and services. As a result, GST gives revenue to the government. GST is included in the final price of all goods / services before purchase. This tax eliminates all indirect taxes that have already been mandated in India by the central government and the state government. GST registration is required for businesses to apply for it.

What is GST return?

GST return is a document containing details of income which as per law is mandatory to be filed with the tax authorities. A taxpayer will have to submit two returns on a monthly basis under the GST Act and one such annual return. You should note that there is no provision for revising returns and all returns have to be filed online. In addition, all invoices for the previous tax period that went unnoticed - should be included in the current month itself. A registered dealer has to file GST returns under GST, including: sales, purchases, input tax credit (GST paid on purchase) and output, GST (on sales).

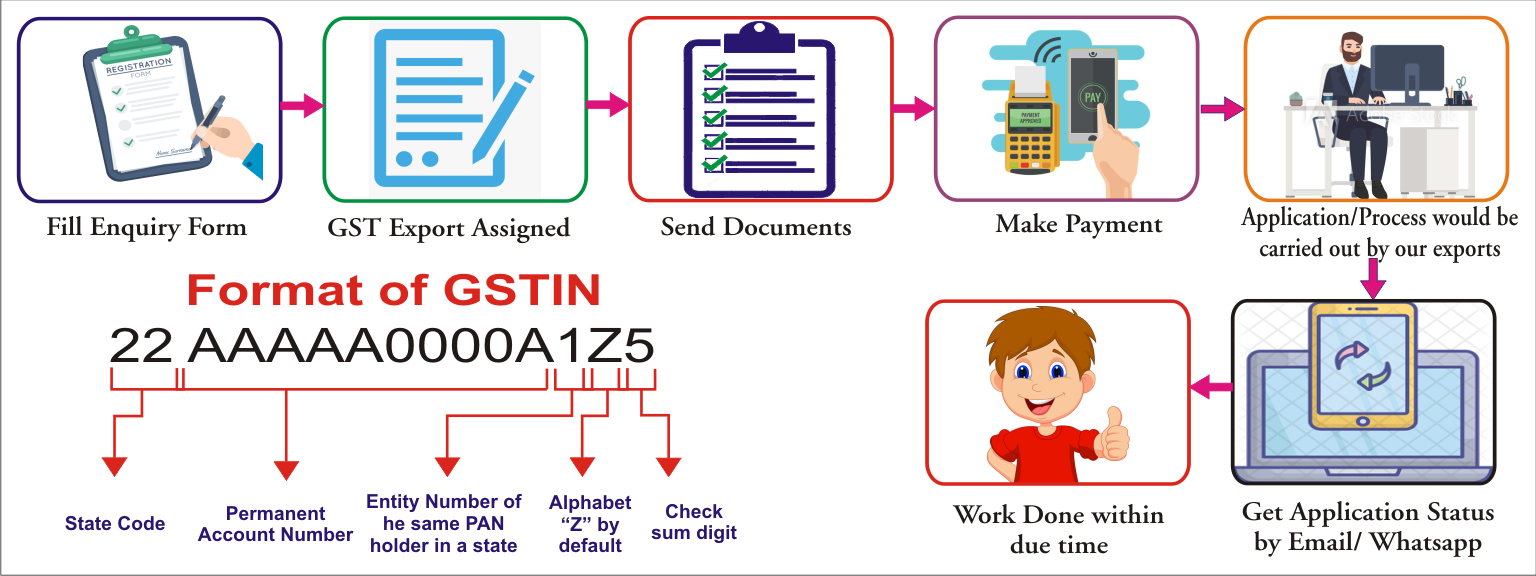

What is GSTIN (Goods and Services Tax Identification Number)?

The GSTIN is a “unique identification number” given to each and every GST taxpayer. A person who has a GST number can log onto the “GST portal” to verify a GSTIN number.

What is the GSTN (Goods and Service Tax Network)?

The GSTN or Goods and Services Tax Network, usually section 8 (non-profit), is occupied by a non-government, private limited company. In addition, GSTN is a one-stop solution for all your requirements for indirect tax. The GSTN is responsible for maintaining, filing, setting all returns and paying its accountability for indirect tax liabilities to the indirect taxation platform for the GST.

What do you mean by GST return filing?

A GST return filing is a return document for taxpayers that details their income, which needs to be filed with the GST Administrative Authority of India. The GST return filing document is used by the authorities to determine and calculate the tax liability of a GST taxpayer which is the following statement.

- Purchases

- Output GST (on sale)

- Input Tax Credit (GST paid on purchase)

- sale

What is the reason behind the implementation of GST in India?

To improve the way tax is collected, the Goods and Services Tax (GST) was implemented in India. In addition, the main reason for implementing GST in India is to reduce the tax burden of both companies and consumers. With the previous tax system many taxes were included in each phase of the production network, without mentioning that the tax has been paid in earlier stages. As a result, the final cost of the item does not clearly show the item's actual price and how much was taxed. It is notable that this cascading structure is highly unreliable and unproductive, which sometimes causes a lot of confusion and repeatedly causes double taxation.

The inclusion of the whole of India at a nodal point through a uniform taxation system instrument as GST (Goods and Service Tax) was a very successful and sensible move of the government. It shoots largely in the context of the Indian economy by removing the long list of taxes that were already imposed by the state as well as the central government.

Who is eligible for GST registration?

- Individuals who are registered under pre-GST law (ie excise duty, VAT, service tax)

- Businesses whose business is above INR 40 lakhs and INR 20 lakhs for North Eastern states, Jammu & Kashmir, Himachal Pradesh and Uttarakhand.

- Taxable person and non-resident taxable person

- Supplier and agent of input service distributor

- Individuals paying taxes under reverse charge mechanism.

- Individuals who supply through e-commerce aggregator

- A person outside India supplying online information and database access from someone in India.

What are the eligible criteria for GST Registration?

The following entities should go to GST registration in India: -

- Persons/businesses making the inter-state supply of goods & services

- All e-commerce aggregators registered under the tax services of the previous regime

- E-commerce aggregator

- Non-resident taxable person / casual taxable person

- Agents of a supplier & Input service distributor

- Supplies online information, database access and/or retrieval services from Foreign Notified by the Central/State Govt./GST Council

What are the Benefits of GST registration?

- The implementation of GST has detached the cascading effect of taxes and removed the ‘taxes on tax’. This has abridged the cost of production significantly for businesses and the effects of Double Taxation

- GST registration works in favor of the development of revenue generation forecasts for the government.

- GST laws and regulations are capable of regulating the unorganized and scattered business sector. In addition, a GST registration recognizes a business as a supplier of goods or services with a valid authority

- GST registration legally certifies a business that collects taxes from its recipients or buyers and passes on the credits adjacent to its taxes.

- GST helps the business to consolidate its warehousing facilities and get better with low cost logistics efficiency.

- With the help of GST registration, small businesses can make available the GST regime to reduce the level of taxation using the composition scheme. In this way, they can significantly reduce their compliance and taxation burden.

- It is worth mentioning that GST is an advantage for MSME sectors. Due to the simplified return filing system in the rules and regulations of GST, MSMEs are less dependent on tax professionals in the context of the previous tax regime.

Mode of GST registration in India:

GST is an indirect tax levied in India, which came into effect from 1 July 2017 to remove geographical barriers and create a single market for all who buy, sell, import and export within our country Is open for

The implementation of GST registration will remove the cascading tax system like CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax), which will ultimately help the consumer.

- CGST (Central Goods and Services Tax)

CGST is a tax levied by the Central Government on intra state supply of goods and services. Intra-state supply of goods or services occurs when the supplier and buyer are in the same state. In this GST registration mode, a vendor has to collect both CGST and SGST in which CGST is deposited with the central government while SGST is deposited with the state government.

- SGST (State Goods and Services Tax)

SGST is a tax levied by the state government on intra state supply of goods and services. The tax levied here goes to the state government.

For example: A dealer in Ghaziabad sold goods worth Rs 10000 to a seller in Meerut. A single tax GST will be levied on goods which include both CGST and SGST. The GST rate will be under the 18% GST slab with both CGST and SGST being 9%. The dealer will have to pay INR 1800, of which 900 will go to the central government and INR 900 will go to the state government i.e. UP government.

- IGST (Integrated Goods and Services Tax)

IGST is a tax levied on the inter-state supply of goods and services which will be governed by the IGST Act. Inter-state supply of goods occurs when the supplier's location and the place of supply are in different states. In IGST, the seller has to collect IGST from the buyer. The tax collected will be shared between the central and state government.

For example: A businessman from Delhi sold goods worth INR 1,00,000 to another businessman based in Mumbai. The GST rate is 18% i.e. the businessman will have to charge INR 18,000 as IGST. This amount will go to the central government.

- UTGST (Union Territory Goods and Services Tax)

UTGST: Union State Goods and Services Tax is the full form of UTGST. The Union Territory Goods and Services Tax is applicable only when any services and goods are consumed in the given five regions of India, including Dadra & Nagar Haveli, Andaman and Nicobar Islands, Lakshadweep, Chandigarh, and Daman & Diu -called as Union territories (UTs) of India. In this sort of revenue is collected by the government of union territory. Union Territory Goods and Service Tax are levied with the CGST only, which are implied on the businesses only after the registration of GST.

What is the structure of slabs under GST?

GST arrangement was done keeping in mind the common man and the rate of inflation. To make it simple and easy, GST was structured after a four-tier structure. These four areas are given below, which are as follows: -

- Zero Rates:

0% zero rate tax means the zero tax applicable to goods and / or services.

- Low Rate:

The lower tax rate determines the 5% tax rate that applies to the CPI (Consumer Price Index) basket & mass consumption.

- Standard rate:

Standard rate includes 12% & 18% of the tax rates. Moreover, the council has finalized two standard rates to maintain the check on the rates of inflation.

- High Rates:

Higher rate tax includes 28% of the tax rate under the GST regulation.

What is the validity of GST registration certificate?

The validity of any GST registration certificate depends and is conditional on the type of taxpayer receiving the certification. It is valid when the certificate is issued to a regular taxpayer. In such cases, it is invalid only when it is canceled by the GST authority or surrendered by the taxpayer himself.

However, validity is restricted to a period of 90 days from the date of registration or for the period specified in the registration application, whichever is in the certificates issued to the contingent taxpayer or non-resident Indian (NRI) taxpayer. Apart from this, the validity period can also be extended by the appropriate authorities under the provisions of Section 27 (1) of the GST Act.

Constituents of GST Certificate

- Registration Number

- Legal name

- Trade name

- Constitution of business

- Date of liability

- Period of validity

- Types of taxpayers

- Signature

How to track GST registration application?

With the following method, you can track your GST registration application

- Firstly, log on to http://gst.gov.in

- Now click on the ‘service’ option available

- After clicking on the service option, a dropdown will provide a result of 'registration.'

- Now choose the ‘track application status’ option

- After choosing the option, you have to enter your ARN in a new window and click on search

- Here, you can see your application status and the same information will be shared on your registered mobile number and email ID.

Another mode to check application status;

- Firstly, log on to http://gst.gov.inwith the help of credential provided to you

- After selecting the Service tab for a drop-down, select option, 'registration.'

- Now click on the option, 'Track Application Status' and after entering the ARN number, click Search.

Procedure for GST Registration

Use the steps above to legally and safely integrate GST registration and receive benefits in the form of taxation. Our experts will be at your disposal for guidance related to GST registration and to help you comply with it for the smooth running of your business in India. Servzone professionals will help you plan at the least cost, confirming the successful conclusion of the process.

It is advisable that an attorney with “Tax experience” Must be appointed to address the many potential pitfalls that creep within the GST registration and understand the requirement in detail. Primary information will be mandatory from your end to begin the process. After providing all the information, and upon receipt of payment the attorney will start working on your request.

Why Servzone?

Servzone is one of the platforms that coordinates to meet all your legal and financial requirements and continuously connects you with professionals. Yes, our clients are pleased with our legal service! Due to our focus on simplifying legal requirements, they have consistently treated us highly and provide regular updates.

Our clients can track progress on our platform at all times. If you have any questions about the GST registration process, our experienced representatives are just a phone call away. Servzone will ensure that your communication with professionals is attractive and seamless.

- Buy a plan for expert support

- Add questions about GST Registration

- Provide documents to servzone Expert

- Prepare for GST Registration + fulfill all acceptance criteria for initial screening

- GST Registration at your door step. Start Business!

As per GST registration guidelines Government of India

According to the Government of India guidelines for GST registration, who should register under GST All Individual. Therefore, the government has provided a list of all potential consumers or sellers: -

- Consumers or sellers who are enrolled under pre-existing taxation laws, i.e. VAT, service tax, excise, etc.

- Those on the shore trading Rs. 40 Lakh * (Rs. 10 Lakh for states counting Uttarakhand, North-Eastern States, Himachal Pradesh and Jammu & Kashmir)

- All the Input service wholesaler and Operators of a supplier

- A person who infrequently supplies taxable goods or services in a chargeable territory is called a “casual taxable” person. For that, there is no fixed place of business that is it shifts from one place to another.

- All persons under consideration of RCM (Reverse Charge Mechanism): In reverse charge, the receiver becomes liable to pay tax. This means that the tax charge will be reversed

- Entire people are involved in e-commerce. It also covers the person who markets equipment and supplies through the e-commerce aggregator.

- Apart from making database access or recovery administrations and web data available to a person in India from a foreign location (foreign), all other than a registered or listed taxable person are entitled to GST registration.

GST Registration

PVT. LTD. Company

Loan

Insurance